More About Bank Account

Wiki Article

The Ultimate Guide To Bank

Table of ContentsThe Of Bank AccountThe Only Guide to Bank Draft MeaningIndicators on Bank You Should KnowExcitement About Bank Reconciliation

You can also save your cash and make passion on your financial investment. The cash kept in the majority of financial institution accounts is government insured by the Federal Down Payment Insurance Policy Firm (FDIC), up to a restriction of $250,000 for specific depositors and $500,000 for collectively held deposits. Financial institutions also give credit history chances for people and also firms.

Financial institutions earn a profit by charging more rate of interest to consumers than they pay on savings accounts. A bank's size is figured out by where it lies and who it servesfrom little, community-based institutions to big commercial banks. According to the FDIC, there were just over 4,200 FDIC-insured industrial financial institutions in the USA as of 2021.

Benefit, rate of interest prices, and also costs are some of the factors that help consumers choose their liked banks.

Bank for Dummies

financial institutions came under intense scrutiny after the international financial dilemma of 2008. The regulative setting for financial institutions has actually given that tightened up significantly consequently. U.S. financial institutions are managed at a state or national level. Depending on the framework, they might be managed at both degrees. State banks are regulated by a state's division of financial or department of financial organizations.

A neighborhood bank, as an example, takes deposits and lends in your area, which might use an extra tailored banking partnership. Select a hassle-free place if you are selecting a financial institution with a brick-and-mortar location. If you have a financial emergency situation, you do not desire to have to take a trip a far away to get cash money.

What Does Bank Mean?

Some banks additionally supply smartphone applications, which can be useful. Some large banks are relocating to end over-limit costs in 2022, so that might be an essential factor to consider.Financing & Advancement, March 2012, Vol (bank code). 49, No. 1 Establishments that compare savers and also debtors help guarantee that economies function efficiently YOU'VE got $1,000 you don't need for, say, a year and desire to earn income from the cash until after that. Or you want to purchase a residence and require to obtain $100,000 and pay it back over three decades.

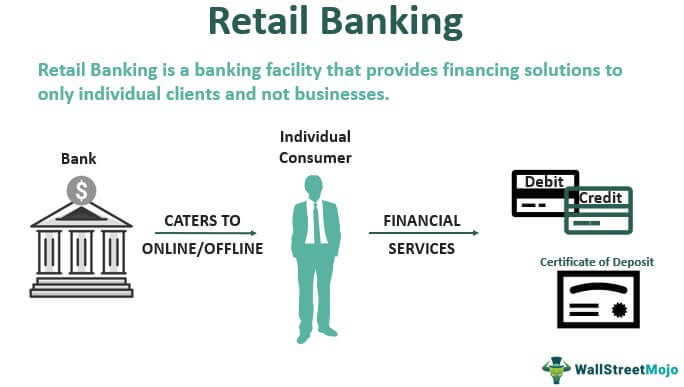

That's where banks can be found in. Although financial institutions do many things, their primary role is to absorb fundscalled depositsfrom those with cash, swimming pool them, as well as provide them to those who need funds. Financial institutions are middlemans between depositors (who provide money to the bank) as well as customers (to whom the bank provides cash).

Down payments can be available on need (a monitoring account, for example) or with some limitations (such as financial savings and also time down payments). While at any given moment some depositors need their cash, the majority of do not.

Not known Facts About Bank Definition

The procedure includes view it now maturation transformationconverting go to the website temporary responsibilities (deposits) to lasting properties (loans). Financial institutions pay depositors much less than they get from debtors, as well as that difference accounts for the mass of financial institutions' revenue in many countries. Banks can match typical down payments as a resource of financing by straight borrowing in the money and funding markets.

Banks keep those needed books on down payment with reserve banks, such as the United State Federal Book, the Bank of Japan, and also the European Reserve Bank. Banks develop money when they offer the remainder of the money depositors provide. This money can be used to purchase items and also services and can find its back right into the financial system as a deposit in one more financial institution, which then can lend a fraction of it.

The size of the multiplierthe quantity of cash developed from a preliminary depositdepends on the amount of money financial institutions need to keep on reserve (bank draft More Help meaning). Financial institutions also offer and also recycle excess cash within the monetary system and also create, distribute, and also profession protections. Financial institutions have a number of ways of making money besides taking the distinction (or spread) in between the passion they pay on deposits and obtained money and the rate of interest they gather from customers or safety and securities they hold.

Report this wiki page